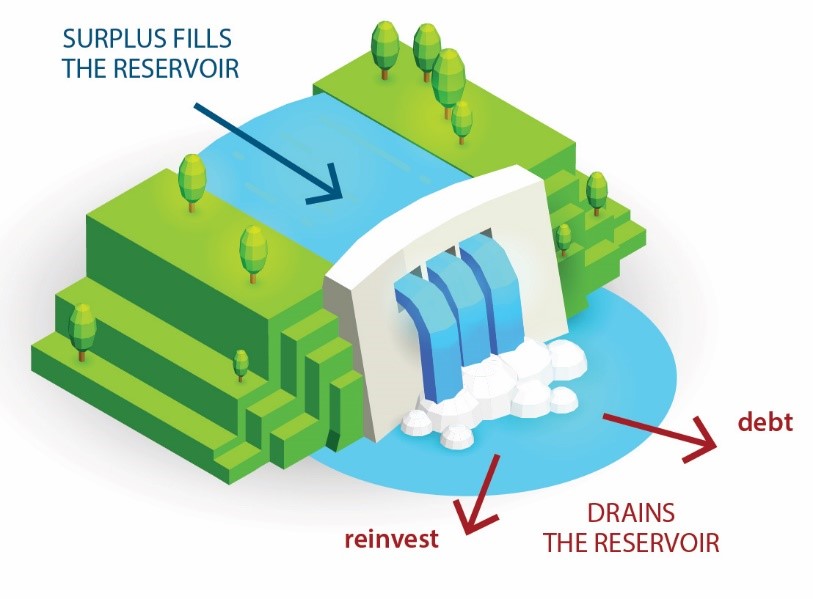

To be sustainable, a school must generate a surplus (cash inflow from operations) that is adequate to meet annual cash outflows for asset replacement and debt servicing. Consider the analogy of water (cash) flowing into the reservoir being sufficient to meet the water (cash) flowing out though the floodgates for asset reinvestment and debt servicing. If the cash inflow is not sufficient the reservoir will run low and may run dry. In years of significant asset reinvestment, the school may supplement the cash requirements from extra borrowings, (pipe water in) and/or use some of the reservoir. But in the medium to long term, cash flowing in each year must be adequate to meet the cash flowing out.[1]

The law requires your school to be financially viable, but in reality, it must be financially sustainable. Financial viability is more of a short-term focus including your ability to pay debts as and when due. Financial sustainability is like multiple periods of financial viability where you continue to pay debts and operate as a going concern into the long-term future.

Enrolments are a key driver of cashflow. If your school doesn’t adequately reinvest and maintain facilities, which often involves debt, this may have an adverse effect on enrolments. School governors and senior managers must therefore ensure that cash flowing in each year is sufficient to sustainably meet the cash flowing out for asset reinvestment and debt servicing.

Governors and management make decisions in relation to fees, curriculum offerings, staffing and other operating matters that affect the annual operating surplus “rainfall”. They also make decisions in relation to reinvestment into buildings plant and equipment which usually results in the need to service debt.

Three important questions are therefore – What is an adequate operating surplus and how can that be influenced? What is adequate reinvestment? What is appropriate debt?

Research indicates three categories for attributes of a financially sustainable school as follows:

- Financial – use of ratios/benchmarks, adequate cash flow and reserves, adequate debt servicing.

- Non-financial – culture that is innovative, future looking and willing to adapt to changed circumstances, stable enrolments, quality service, staff and facilities (adequate reinvestment).

- Leadership and Management – quality board, governance and management including financial literacy skills, good strategy, reliable, accurate, timely budgeting and reporting and, balancing competing needs of various stakeholders. This paper focuses on the financial attributes.

In the era of business process transformation, we should allow machines to do what they do best: performing repetitive tasks like collecting and analysing data so that humans can do what we do best: resolving ambiguous information and exercising judgement. The ASBA/Somerset Non-Government Schools’ Financial Performance Survey (FPS) turns data into information, enabling you to synthesise it to make well-informed decisions on the financial management of the school.

The FPS is a school financial ratio and benchmarking survey that has operated for more than 25 years. Participants represent more than 70% of enrolments in independent schools, 98% of participants rate the survey good to excellent and 100% recommend it to others. A crucial attribute of a financially sustainable school is the use of trend and comparative ratios in school management and governance. Are you using comparative and trend ratio analysis in the management of your school? The FPS is an easy way to do so.

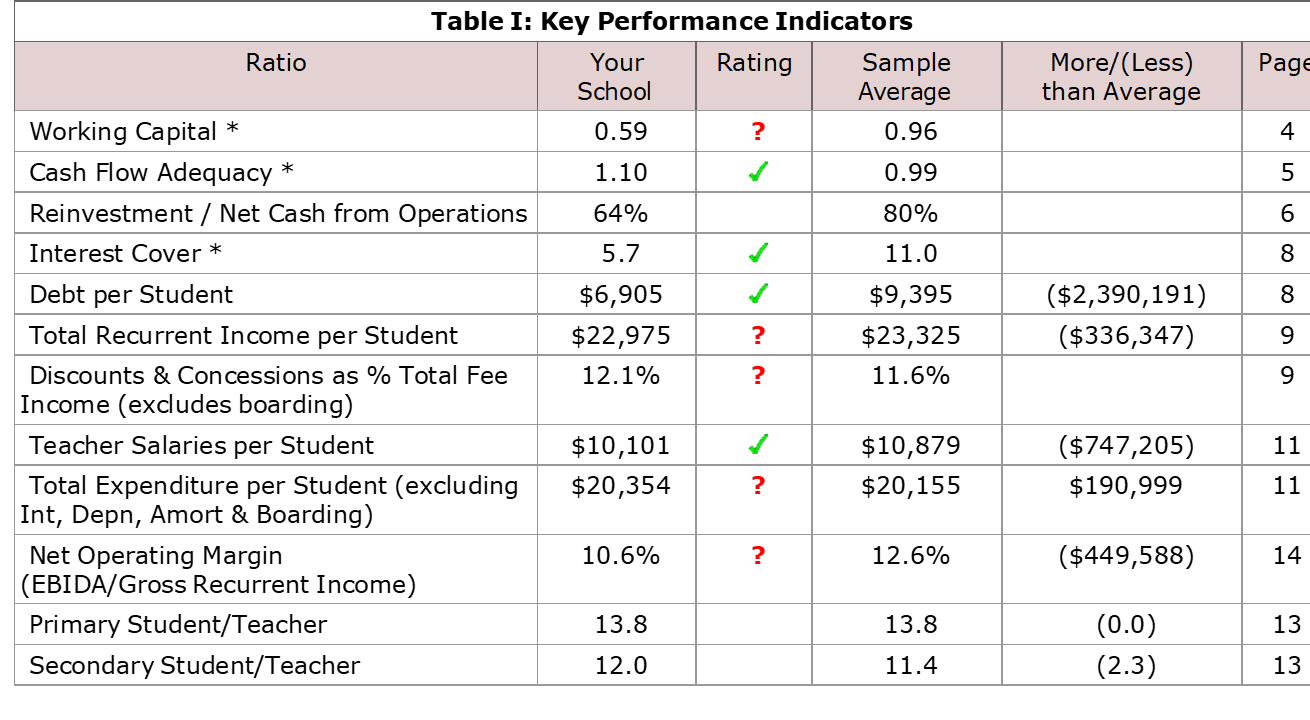

Each year approximately 700 schools log into the survey at www.somerseteducation.net to enter/upload data directly from their Department of Education Financial Questionnaire and Federal student and staff census. So, data definitions are consistent, which means reliable comparisons. A sample of similar schools is selected, and a report is instantly compiled calculating 60 ratios for the school and comparing performance with sample averages, plus graphing and commenting on performance for a selection of key ratios – see the sample in Table I.

Schools can use this information to identify and quantify strengths and weaknesses and set strategies accordingly.

Another key attribute of a financially sustainable school is the ability to adapt to changing circumstances. Annual participation in the survey allows a school to produce a historical report to assess trends in their ratios for the past six years. The Somerset Key Indicator (SKI) Report also allows the entering of budget data to analyse proposed future trends in performance for up to five years – helping assess the future financial health from decisions being made now.

Using depreciation (the rate at which assets wear out) as a proxy for minimum asset reinvestment, and adding this to minimum debt repayments, we can estimate the annual cash outflow required from the reservoir ‘floodgates’. Comparing this to the annual operating surplus helps assess sustainability. For example, if depreciation is $250,000 and debt repayments are $150,000 per annum, the school should generate an annual operating cash surplus of at least $400,000 to be sustainable.

The FPS will do much of the analysis to help you assess sustainability and identify and quantify possible improvements in performance if required.

So, what is an adequate operating surplus for your school depends on the annual cash required for asset reinvestment and debt servicing. If your school decides to significantly increase debt, then you are also committing to a need for high cash surpluses. You don’t have to be the best or have the highest operating surplus – the least financially healthy school may still be sustainable. It is about what is enough for your school.

These simple principles apply whether you are a new school with a handful of enrolments or a long-established school with thousands of enrolments, or if enrolments are stable or changing (up or down). If you are looking for help to operate in an efficient and effective manner and sustainably fund capital reinvestment and debt servicing, I encourage you to participate in this long-established FPS.

For further information, please contact Somerset Education at info@somerseteducation.net or telephone 1300 781 968

[1] Somerset J.W.P. (2017) Attributes of a financially sustainable independent school. (Master of Business), Queensland University of Technology

John Somerset,

Director Somerset Education

Article posted with permission from Somerset Education.